Better Time to Buy Than to Sell

November 25, 2020

District 10 City Councilman Clayton Perry, commented that San Antonio has experienced a 34% decline in small businesses due to COVID. This is the worst hit of any city in Texas, illustrating how dependent SA is on small entrepreneurs. Then, our City Council has $75-million available from the CARES Act that he felt should have been made available in direct aid to help small business, but instead the funds were allocated to long term job training programs in workforce development. He and Councilman Trevino in District 1 along with a few other Councilmembers are looking to tap into that $75m set aside to allocate it towards small businesses in the hospitality and restaurant industries that have been especially hard hit by COVID. The $75m is not directly tied to the sales tax proposition that was just overwhelmingly approved in November, although it is being marketed as a “first phase” of that program. It is important to note that while the Workforce Development Proposition passed overwhelmingly in the recent election, there is no actual plan, just funding.

Contrast this with Austin that actually initiated a grant program worth $16.5-million for grants up to $40,000 to help local businesses. This is one program that San Antonio should have emulated (unlike the Sick Leave fiasco). Rather our City leaders opted to fund education bureaucracies for several years, with vague goals and no implementation program. Wouldn’t it be better if our leaders helped failing businesses by direct grants instead? That helps workers right now that are in very bad need of support.

Is this a good time to invest in commercial real estate in San Antonio?

Better time to buy than to sell. Here are details from the Real Capital Analytics data presented at the recent CCIM Symposium. Industrial investment sales totaled $452M sales volume over the past 12 months, down 15% Y-O-Y from a near record year. In 2012 we had about $150M in sales, so we are still very solid for investment deals.

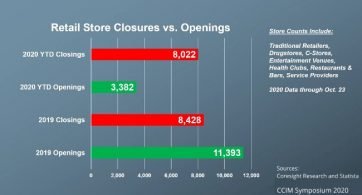

Retail investment sales were $417M in the past year, at $180/SF, near the average. So, while, E-Commerce doubled due to Covid, the largest store closings in town have been Beall’s, Stein Mart, Pier One and Tuesday Mornings; 29 stores in all for 575k SF. Compared to Austin, San Antonio has a higher vacancy rate (5.8% vs 4.6%) and lower rents ($16.35 vs. $21.59). Cap Rates have edged higher to 7.6% vs. 7.4% last year, and sale prices average $209/SF this year vs. $228/SF last year. Debt is still available, but lenders are very picky. Most believe it will take a year or two to recover, once the vaccine is available.

Average retail absorption over the past 10 years is 730k SF per year. But in the past year it is only down 184k – not bad considering all of the headwinds facing retail. Retail vacancy has averaged 5.8% over the past 10 years, but now has ticked up a little to 6%. We typically build nearly 1M SF of retail space a year, but only just over 800k the past year. Still healthy and asking rates are up 11.2% since 2015; to $16.35 nnn.

Office absorption has averaged 633K SF over the past 10 years, but only 37K SF this year. Wonder why! Vacancies had actually been declining for years, but have ticked up this past year to 9.6%, with Class A being the most at 13%. Sales volume was $494M, down a whopping 39%!

So, overall, we are looking pretty good, considering this dumpster fire of a year. Can’t wait to say “Happy New Year 2021!”